What is this site?

The TL;DR is that I paid an accountant named Marie Azam to do an incorporation and some tax returns for me, and she never sent me any documents and refused to refund my money. I am currently preparing a small claims lawsuit against her.

In reviewing public records for the lawsuit I stumbled upon a troubling pattern of facts about her current and past business practices, and I think there is a public interest served in presenting that here. I wish I had this information before doing business with her.

I have asked her to tell me if anything on this site is inaccurate, and while she has threatened legal action against me she has not disputed any of the facts. I will try to present the information in a fair and neutral manner. If you have anything to add or correct please send me an email.

Who is Marie Azam?

Her current venture is Transatlantic Tax Advisors / LCT World. Her email signature gives her position as Head of Cross-Borders Tax Department, but I believe she is the sole owner.

On her LinkedIn page, Marie Azam claims to have a Master of Laws (LL.M.) in Banking, Corporate, Finance and Securities Law from Sciences Po (The Paris Institute of Political Studies), also studying at the Université Paris-Sorbonne.

She regularly posts influencer-style content on her Linkedin profile and company facebook page. She markets herself as having expertise in transnational tax issues.

Based on public records, she has operated companies in both the U.S. and UK.

UK business history

She has had several companies on the official Companies House website.

In 2013 Azam Worldwide LLP was forced to dissolve by a court after a creditor filed suit against them. As described in the court order above, apparently no one showed up to defend the company. In fact, according to public records all of the officers had filed notices of resignation in the months prior, so it seems that there wasn’t much of the company left at that point.

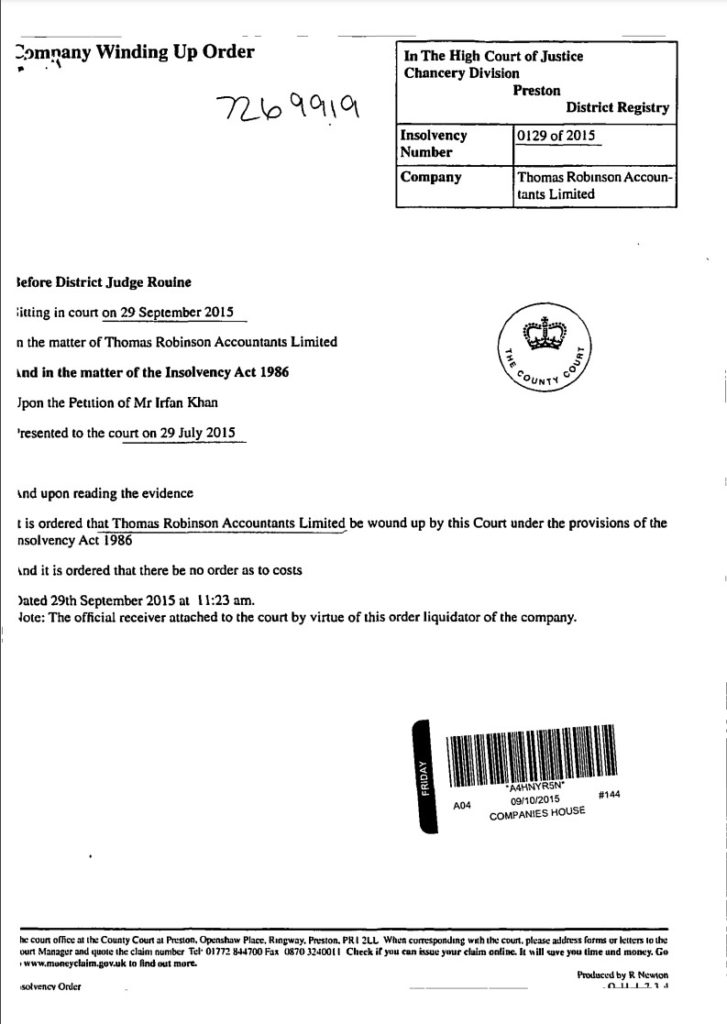

In October 2015 her other company (which had several names) was also ordered dissolved by a court after a creditor filed suit against them. But just two years earlier the company (then known as EMAW LTD) filed a balance sheet showing that they had almost 3 million GBP in net assets ($4.5M USD at the time), including over 2.5 million GBP ($3.75M USD) cash in hand. However, in July 2015 the company filed a balance sheet listing only 20 GBP (yes, twenty) in total assets.

So where did all that money go? Well, one rather interesting detail is the annual report of the liquidator assigned by the court, a portion of which is shown below:

to excerpt the key information:

Our agents obtained court orders that have enabled us to obtain documents that have allowed us to trace funds leaving the company bank accounts.

They are currently seeking to trace certain individuals… the information that we have suggests that any assets may be outside the UK and this is making the track and trace work considerably more complicated.

To reiterate, while this company had several officers, it was wholly owned by Marie Azam. Two years after a liquidator was appointed, they notified the court that they were not able to recover any of the funds and recommended that the liquidation be closed out. The company was finally dissolved in March 2019.

U.S. business history

In the U.S., she has several companies registered in California and New York under variations of the name EMAW (Expatriation Management Azam Wordwide).

Ironically for a tax professional, since at least 2019 all her companies in California are suspended or forfeited for non-filing of corporate info or non-payment of franchise taxes. In fact, she has a lien for $36,000 for unpaid taxes in California. However, this is not the largest lien filed against her.

The Rimbot lawsuit

In 2015 Azam was sued by a french couple alleging breach of contract, breach of fiduciary duty, and Money Had and Received (essentially, if you are supposed to return someone else’s money and you don’t).

Unfortunately the documents available online from the Superior Court of California do not include the initial complaint or final judgement, but reading through the case summary (search for case #BC578581), it seems as if Azam once again didn’t show up for the initial court hearing. Evidence was then presented and a judgement was made against her. Then, she hired a lawyer and tried to have the judgement set aside on the basis that she was not properly notified of the lawsuit. Her motion to do so has this rather amusing passage:

Much of the Opposition is an attempt to smear and undermine the credibility of the Defendant… While Defendant disputes almost all the facts alleged by the Opposition concerning her character and whereabouts during the period in question, this is not the hearing at which detailed factual responses must be made.”

I like to imagine the judge saying: ‘Yes! The hearing at which factual responses must be made is the one you didn’t show up at!‘

Anyway, evidence was presented that she was in fact properly served, and so the judgement stands.

That judgement? $2,504,300.

My experience with Marie Azam

I own a small business which has started to do pretty well, and in recent years I also married a foreign national, moved to another country, had a baby, and bought a house. So my tax situation has gotten more complicated. Marie seemed like an ideal choice to help navigate all that.

I contacted her about helping me incorporate my company, and after reviewing my tax returns she also suggested filing amended tax returns for the past three years which she said could save me on the order of $10K USD. Sounds good I said, and paid her.

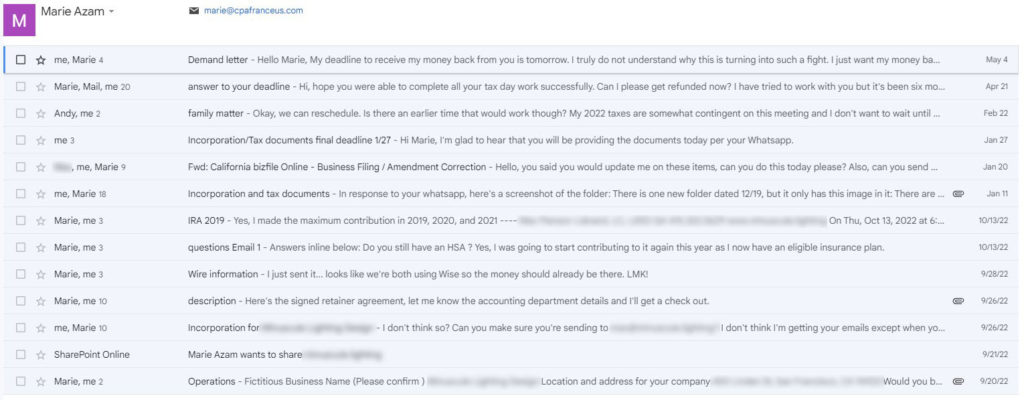

Initially, she was very responsive, asking for relevant documents and info. Then things got weird. Every time I would ask when the documents would be ready, she would say something like “by tomorrow” or “by the end of the week” or “by midnight tonight” (?!). She would say that the documents were only available on the company servers, so she couldn’t access them, but would send them later that day or tomorrow. Each time, the promised time would pass with no communication from her, then I would follow up, resulting in a new promise, etc. She would frequently promise to refund part or all of my money, which is also an odd thing for a tax professional to do. So that went on for several months.

I asked if we could loop in someone else at LCT World / Transatlantic Tax Advisors so that we can keep things moving while she’s travelling or busy. She added someone named Andy Bloomberg to the email chain, but… I don’t think he exists? He has no LinkedIn profile, nothing comes up on Google, and the only time I ever received any communication from him was a single email a few hours before a planned videoconference where Marie was finally going to show me the documents I paid for. His email said simply that he had a family emergency and would need to postpone indefinitely. I asked Marie to do the videocall anyway, and she agreed and then… never showed up. Marie was also a no-show when we rescheduled the meeting. She claimed to have to drive into Paris to access the documents (?), then claimed to be stuck in traffic, offered to refund part of my money for the trouble, then, didn’t show up at the videoconference, and didn’t respond to requests for updates or a new time to meet.

As you can probably tell, all of this has wasted hours and hours of my time. It’s infuriating, and also bizarre: She would seemingly have the expertise to execute the services requested in an afternoon. She has seemingly spent more time than that making excuses to me. What is going on here?

One odd detail came up that made me wonder about her claimed expertise. So I asked that even if she was still working on the amended tax returns could she please send me the incorporation. She forwarded me the following email:

To briefly explain the above email, there are special corporation structures for regulated professions like doctors, lawyers, engineers etc. I am not one of those professions and so what the reviewer is telling Marie in this email is that she should have submitted the application as a general corporation instead of a special professional corporation. Which is a somewhat reasonable mistake to make… if you’re not a tax professional with both a tax and law degree. For someone with her claimed expertise, it’s a very odd mistake.

Conclusion

So what do we make of all this?

In California, her companies are not in good standing with tax and regulatory requirements and she personally has sizeable liens against her for unpaid taxes and a lawsuit judgement for $2.5 million dollars.

In the UK, she had two companies forcibly dissolved by a court at the request of creditors, and an inquiry was opened after $4.5 million dollars were precipitously removed from the country in such a way as to make it impossible for creditors to recover their losses.

My professional dealings with her were very Dog Ate My Homework. Which again, is just weird. If you hire some shadetree mechanic to work on your car, and he gives you excuses instead of fixing it, well should have hired a pro, right? But I thought I was hiring a pro. In my own business, I run a profit by completing a service within the number of hours that my clients are paying me for. If I were to spend hours and hours making elaborate excuses instead of just getting the work done, that would be much less profitable in addition to having angry clients in addition to being exhausting. Repeat and referral customers is the key to having a sustainable small business.

So what is really going on here? I don’t understand it but if you think you have some info that might be useful, please do email me.

Postscript: In May of 2022, Marie Azam incorporated in the UK as Corage LTD. The company is currently behind on their filing requirements.